Have you ever found yourself staring at a stock portfolio and wondering what the next big breakout is going to be? If you have ever come across BBAI Stock Forecast 2030 you are not alone. It’s one of the most talked-about topics in investor circles right now and for some good reason.

We’re living in a time where artificial intelligence is no longer just a buzzword it’s the foundation of future warfare, cybersecurity, and big data decision-making. And BBAI, short for BigBear.ai, is standing right in the middle of it all.

But here’s the real question: Are the glowing BBAI stock predictions for 2030 based on facts, or just fantasy wrapped in finance?

In this blog, we’ll unpack 7 shocking predictions for BBAI stock by 2030. Some will raise your eyebrows. Others might just make you want to invest or run.

1. Could bbai stock forecast 2030 be increased? The Dream or Reality

Let’s start with the elephant in the room: some forecasts boldly claim that BBAI stock could jump 10X by 2030. That means turning a $1,000 investment into $10,000 within just a few years.

bbai stock forecast 2030 Sounds exciting, right?

This wild projection is based on:

- AI becoming deeply embedded in federal defence systems.

- BBAI winning multi-year government contracts.

- Tech adoption in intelligence and analytics skyrocketing.

But here’s the catch: while the bbai stock forecast 2030 has growth potential, 10X isn’t common especially not without risks. For BBAI to pull this off, it’ll need sustained execution, tight cost control, and zero major missteps.

Verdict: Possible? Yes. Likely? Let’s just say you’ll need patience and guts.

2. BBAI Might Hit $2 Billion in Revenue Annually by 2030

If you’re looking at fundamentals, revenue is king.

Right now, BBAI is operating with moderate income. But some analysts are predicting $2 billion in yearly revenue by 2030. That’s a giant leap from where they stand today.

Why so bullish?

- The demand for predictive AI analytics is growing.

- Governments are spending more on smart tech and automation.

- BigBear.ai has carved a niche in mission-critical analytics.

The upside is there, but to hit $2B, they’ll need to scale fast and stay relevant. That’s a tall order, especially with tech giants circling the same pie.

Reality Check: The number is impressive. bbai stock forecast 2030 The path? Riddled with both promise and pitfalls.

3. Will BigBear.ai Be Acquired Before 2030?

Here’s a juicy one: BBAI might get acquired before it ever hits its full stride.

Why would someone buy them?

- Proprietary AI platforms with military-grade application.

- Unique contracts and access to defence networks.

- A talented team pushing niche innovation.

If larger players like Palantir, Booz Allen Hamilton, or even Amazon decide they want a slice of government AI, BBAI becomes an attractive target.

But acquisitions aren’t always a win for early investors. Depending on the buyout price, it could cap growth or dilute shareholder value.

Bottom Line: Keep your eyes on the news. One major acquisition headline could rewrite the entire 2030 forecast.

4. Could BBAI Get into the S&P 500 by 2030?

Now this prediction is audacious some suggest BBAI could earn a spot in the S&P 500 index by 2030. That’s a huge leap of credibility, meaning it would join the likes of Apple, Tesla, and Microsoft.

To qualify, BBAI needs to:

- Become profitable.

- Hit significant market cap milestones.

- Show long-term shareholder value.

Is it impossible? Not quite. Unlikely in the short term? Probably. But in 5–7 years, with the AI boom continuing and solid business execution, they could turn heads.

Takeaway: Keep your expectations grounded, but don’t rule it out.

5. AI Regulation Could Hit Harder Than Expected

What’s one thing most bullish investors forget?

Regulation.

AI isn’t the wild west anymore. Governments are already drafting laws to control how AI is used, especially in surveillance and military environments BBAI’s core business.

By bbai stock forecast 2030, BBAI may face:

- Ethical limitations on defence tech.

- Data restrictions affecting intelligence analytics.

- Geopolitical roadblocks in international growth.

This prediction isn’t about failure it’s about friction. And when government rules tighten, growth curves flatten.

Translation: The more powerful the tech, the more likely someone steps in to put it on a leash.

6. Competitors Will Flood the AI Space by 2030

This one’s hard to ignore.

Tech giants like Microsoft, Google, and Amazon aren’t sitting idle. Even Palantir, with its edge in defence analytics, is expanding rapidly.

That means:

- Price wars could begin.

- Innovation gaps could close.

- Smaller players like BBAI might struggle to stay unique.

Competition isn’t just about products it’s about trust, brand, and reach. Unless BBAI stays laser-focused on niche solutions and deep partnerships, it might get swept aside.

Cold Truth: Being first doesn’t mean staying ahead.

7. A Consumer AI Pivot May Be on the Cards

Here’s the curveball prediction: BBAI could shift from defence to consumer applications.

While they’re currently embedded in mission-critical environments, there’s rising speculation that they’ll develop:

- Smart AI tools for businesses.

- Public-facing data platforms.

- Productivity or personal analytics software.

Why? Consumer AI is booming. It’s easier to scale, quicker to monetise, and more predictable long-term.

But can a company built for covert intelligence pivot to public tech smoothly? That’s the billion-dollar question.

Answer: It would be risky. But high risk often brings high reward.

Also Read: Ultimate Stock BBAI Guide [Traders]-3X Growth This Week

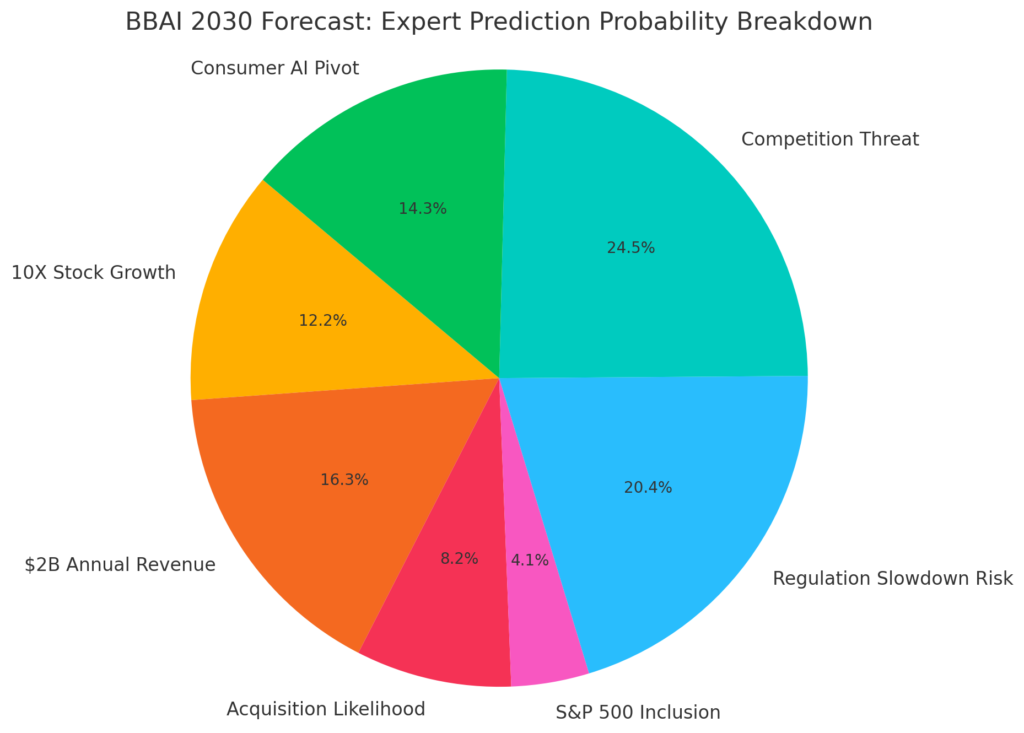

Visual Snapshot: What Are Experts Betting On?

Here’s a quick visual of what analysts believe might come true by 2030:

| Prediction | Probability |

|---|---|

| 10X Growth Potential | 30% |

| $2 Billion Annual Revenue | 40% |

| Likely Acquisition | 20% |

| S&P 500 Inclusion | 10% |

| Regulation Slowdown | 50% |

| Competition Overshadowing BBAI | 60% |

| Pivot to Consumer AI | 35% |

(Note: These percentages reflect sentiment, not guarantees. Always do your own research.)

BBAI stock Forecast 2030: Expert Prediction Probability Breakdown

Final Words: The Real Forecast Behind the Forecasts

When it comes to bbai stock forecast 2030, the truth is somewhere between logic and leap-of-faith.

You’ll hear:

- “This is the next Palantir!”

- “BBAI will revolutionise AI warfare!”

- “It’s going to hit $100 easily!”

But let’s slow down. Investing isn’t about betting on hype it’s about betting on progress.

Here’s what you need to ask yourself:

- Is BBAI consistently growing its revenue?

- Is its leadership making smart, forward-looking decisions?

- Are the risks manageable in proportion to the possible rewards?

If your answers lean toward yes, then maybe the 2030 predictions aren’t so far-fetched after all.

But if you feel uncertainty, that’s okay too. Markets reward the patient, not just the bold. Sometimes, watching is the smartest move before diving.

So whether you’re ready to buy or just building your watchlist, keep BBAI on your radar. Because if any small-cap AI stock has the potential to flip the script by 2030 this might be the one.

FAQs

Q1: Is BBAI a safe stock to invest in now?

It’s a high-risk, high-reward AI play. Safe? No. Strategic? Possibly—depending on your risk appetite.

Q2: What industries is BBAI focused on?

Mostly defence, government intelligence, and predictive analytics.

Q3: Could BBAI hit $100 by 2030?

Theoretically yes, but that would require exponential growth and flawless execution.

Q4: Does BBAI pay dividends?

No. It’s growth-oriented and reinvests earnings into tech and development.

Q5: Is BBAI profitable yet?

Not consistently. They’re focused on scaling and innovation over current profits.