In a world where you can buy groceries with a tap, book flights in seconds, and have your entire life managed through an app why should applying for a mortgage still feel like pulling teeth?

If you’ve heard whispers about the Starling Bank mortgage experience being faster, easier, and smarter than the rest, you’re not imagining things. In 2025, this digital-first bank is making serious waves in the property world and first-time buyers are paying attention.

But here’s the surprise: getting a mortgage from Starling isn’t just about rates or forms. It’s about rethinking how home financing should work in a digital age.

Whether you’re saving for your first home or ready to switch lenders, this guide breaks down 5 surprisingly simple steps to help you unlock your Starling Bank mortgage in 2025 without drowning in paperwork or waiting weeks for answers.

Step 1: Everything Starts With Your Phone – No Paper, No Queues

Let’s begin with the most refreshing part: the entire Starling Bank mortgage process starts from your mobile. Seriously.

Once you open a Starling current account, you can access mortgage options directly inside the app. No printing. No appointments. No awkward phone calls with someone you don’t know.

Here’s what you’ll find inside:

- A real-time mortgage calculator tailored to your finances.

- Pre-qualification checks in minutes using your account data.

- Personalised rates from partnered lenders all without leaving the app.

If you’ve ever felt overwhelmed by paperwork, Starling makes that fear vanish. In fact, many users say it feels like booking a hotel, not applying for a mortgage.

By keeping things mobile-first, Starling Bank mortgage users are empowered to explore, apply, and track every step in their own time without pressure.

Step 2: Starling Looks at More Than Just Your Credit Score

One of the biggest surprises? Starling Bank doesn’t judge you by credit score alone.

Yes, your credit history still matters but the magic lies in Open Banking insights. That means:

- They can view your income, spending, and saving patterns in real time.

- They consider real-life context behind your money habits.

- They reward consistent behaviour not just numbers.

Let’s say your score took a hit last year due to a medical emergency. Traditional lenders might reject you outright. But a Starling Bank mortgage might still see you as stable, responsible, and a worthy borrower.

This humanised approach is powered by clever algorithms but it still feels deeply personal. It’s banking with empathy, not just risk assessment.

Step 3: You’ll See Offers from Multiple Lenders – Instantly

Here’s what most people don’t know: Starling doesn’t just offer their own mortgages. Instead, they act like a curated marketplace inside their app.

When you apply for a Starling Bank mortgage, you’ll get personalised offers from:

- High-street lenders

- Specialist digital lenders

- Alternative finance providers

Each offer includes:

- Interest rate (fixed or variable)

- Repayment period

- Estimated monthly payments

- Approval likelihood

This makes comparison effortless. You don’t have to chase brokers or fill out five separate forms just to weigh your options.

Even better? All offers are pre-filtered for your financial profile so you only see what you’re likely to get. That’s smart, time-saving, and confidence-building.

Step 4: Submit Your Documents Digitally – No Printing Required

Gone are the days of digging through drawers for payslips and utility bills.

With a Starling Bank mortgage in 2025, you’ll upload documents directly through the app:

- Bank statements

- Proof of ID

- Employment contracts or tax returns

- Deposit confirmations

Starling also connects to:

- HMRC for income verification

- Your employer’s payroll (with permission)

- Other banks via Open Banking APIs

Each step includes real-time feedback so you’re never left wondering, “Did they get my documents?”

This paperless process is ideal for busy buyers, remote workers, and self-employed professionals basically anyone who hates faffing with folders.

Step 5: Get Approved, Sign Online, and Track Everything in Real Time

The final stretch? Just as seamless.

Once approved, you’ll:

- Receive a digital mortgage offer.

- Sign it securely using an e-signature platform.

- See a checklist with remaining steps (like valuation and solicitor coordination).

- Get live updates through the Starling app.

No more chasing brokers.

No more “We’ll call you next week.”

No more wondering where your mortgage sits in the queue.

By the time you reach this point, the entire journey has been:

✅ Transparent

✅ Easy to understand

✅ Almost entirely stress-free

In 2025, Starling Bank mortgage customers are closing deals weeks faster than traditional applicants and with way fewer headaches.

🏡 What Makes Starling Different From Traditional Mortgage Lenders?

Here’s a quick side-by-side comparison to show just how far Starling is changing the game:

| Feature | Starling Bank Mortgage | Traditional Bank Mortgage |

|---|---|---|

| Mobile Application Process | ✅ Yes | ❌ Rarely |

| Real-Time Pre-Approval | ✅ Instant | ❌ Several Days |

| Paperless Submission | ✅ 100% Digital | ❌ Mostly Paper-Based |

| Open Banking Affordability Check | ✅ Personalised | ❌ Generic Credit Models |

| Multiple Lender Options | ✅ Curated Offers | ❌ Often In-House Only |

| In-App Progress Tracking | ✅ Live Status Updates | ❌ Email or Phone Calls |

💡 Extra Tips Before You Apply for a Starling Bank Mortgage

If you want to boost your chances and smooth the journey, keep these tips in mind:

- Open a Starling account early – Let them observe your financial behaviour over time.

- Keep your income consistent – Avoid sudden drops or erratic deposits.

- Minimise overdraft use – Lenders view this as risk behaviour.

- Start saving your deposit now – The more you can put down, the better your deal.

- Use their in-app calculators weekly – It’ll help you understand what you can realistically afford.

🚫 3 Common Myths About Starling Bank Mortgage – Debunked

“You need a perfect credit score.”

→ False. Starling values your real financial story, not just a score.

“Digital mortgages are risky.”

→ Nope. Starling is FCA-regulated and uses encrypted, bank-grade security.

“It’s all automated you can’t talk to a real person.”

→ Actually, you can reach mortgage specialists through in-app chat or by phone.

Also Read Here: How Experts Use a Savings Secured Loan to Build Wealth

Where Starling Bank Stands Out

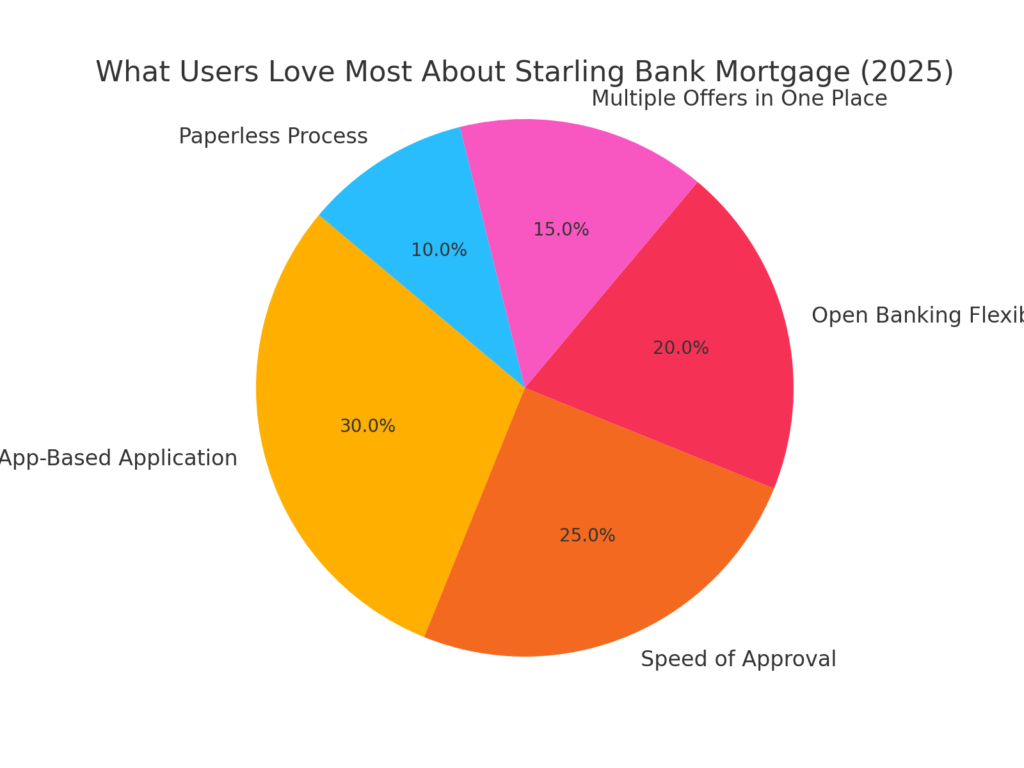

To visualise what users love most about the Starling Bank mortgage experience, here’s how they rank its best features:

| Feature | Popularity (%) |

|---|---|

| App-Based Application | 30% |

| Speed of Approval | 25% |

| Open Banking Flexibility | 20% |

| Multiple Offers in One Place | 15% |

| Paperless Process | 10% |

Is Starling Bank Mortgage Right for You in 2025?

Let’s be honest: the mortgage world hasn’t exactly been built for modern humans. Confusing terms, ancient systems, endless waiting… it’s enough to make anyone second-guess homeownership.

That’s why Starling Bank mortgage products are such a breath of fresh air in 2025. They’ve designed the process around you not outdated policies or internal bureaucracy.

If you’re:

- Comfortable with tech,

- Craving simplicity,

- Or just tired of being ghosted by your bank…

…then Starling might just be your perfect match.

You’ll still need good financial habits. You’ll still need to prove your income and affordability. But if you want a faster, smarter, and far less stressful route to your dream home, Starling Bank mortgage could be the way forward.

FAQs

Q1: Can I get a Starling Bank mortgage without being a customer?

No you’ll need a Starling current account to start the process.

Q2: Are rates competitive with high-street banks?

Yes. Starling compares deals from multiple lenders to help you find the best fit.

Q3: Is it suitable for self-employed buyers?

Absolutely. Open Banking makes it easier for self-employed applicants to prove income.

Q4: How long does it take from application to approval?

Many users report getting mortgage offers in as little as 48 hours.

Q5: Does Starling handle the legal side too?

They coordinate with solicitors and provide a checklist but don’t replace legal representation.

Q6: Can I remortgage through Starling?

Yes. The same app-based process applies for remortgages with partner lenders.