In a year dominated by AI breakthroughs and market shakeups, stock bbai has emerged as one of the most explosive opportunities for active traders. With its roots in defence-focused artificial intelligence and real-time analytics, stock bbai is no longer flying under the radar it’s powering through charts, gaining interest from pros and retail traders alike.

This blog post is your ultimate guide to trading bbai with a smart strategy to help you triple your returns within a single week yes, that fast. Whether you’re new to technical trading or a seasoned chartist, this guide breaks down key entry points, catalysts, risk management, and more.

What Is Stock BBAI and Why Traders Love It

Stock bbai refers to BigBear.ai Holdings, an AI company delivering analytics for military, logistics, and business intelligence sectors. Its recent contracts and AI product releases have made it one of the most volatile and talked-about small-cap stocks in 2025.

Why traders are excited:

- High intraday volatility = quick profits

- Strong retail interest = momentum moves

- Repeatable patterns on charts = predictable trades

- AI trend tailwinds = long-term upside

📈 Technical Setup: How to Read Stock BBAI’s Chart Like a Pro

To trade this efficiently, you need to understand its technical rhythm. Here’s what matters most:

- Support Levels: $1.60 and $1.85 have historically held strong.

- Breakout Zones: Anything above $2.20 on volume is considered bullish.

- Indicators That Work:

- RSI crossing above 50 = buying momentum

- MACD crossover = potential swing entry

- Volume spikes = imminent breakout

Set alerts for trend lines and Fibonacci retracements to anticipate price surges in this stock.

Also Read Here: UNH Stock Price Update: Is Now the Best Time to Buy?

This Week’s Trade Plan to 3X Gains with Stock BBAI

Here’s a trader-tested strategy designed to triple your returns with stock bbai in just 5 trading days.

Day 1-2: Setup & Watch

- Look for a breakout from tight consolidation

- Place alerts at resistance levels

- Scan for increasing volume

Day 3: Enter the Position

- Enter on breakout confirmation above the 20-day moving average

- Buy in two parts: initial entry + volume confirmation

Day 4: Trail Stops and Ride Momentum

- Use a 5% trailing stop

- Take 50% profit at 20-30% gain

Day 5: Sell the Spike

- Exit remainder at breakout top

- Review setup for re-entry next week

When this stock moves, it moves fast this approach lets you capitalise while managing downside risk.

Mindset & Risk Management for Trading Stock BBAI

Successful bbai trading isn’t just about strategy it’s about mental strength. Here’s how to stay sharp:

- Accept Volatility: Expect wild swings; don’t panic.

- Use Stop-Losses: Always protect your capital with automated exits.

- Trade the Plan: Emotional trading kills profits. Stick to entries and exits.

- Don’t Chase: Wait for proper setup. Chasing stock bbai after a spike often leads to losses.

Managing your mindset is as crucial as managing your money.

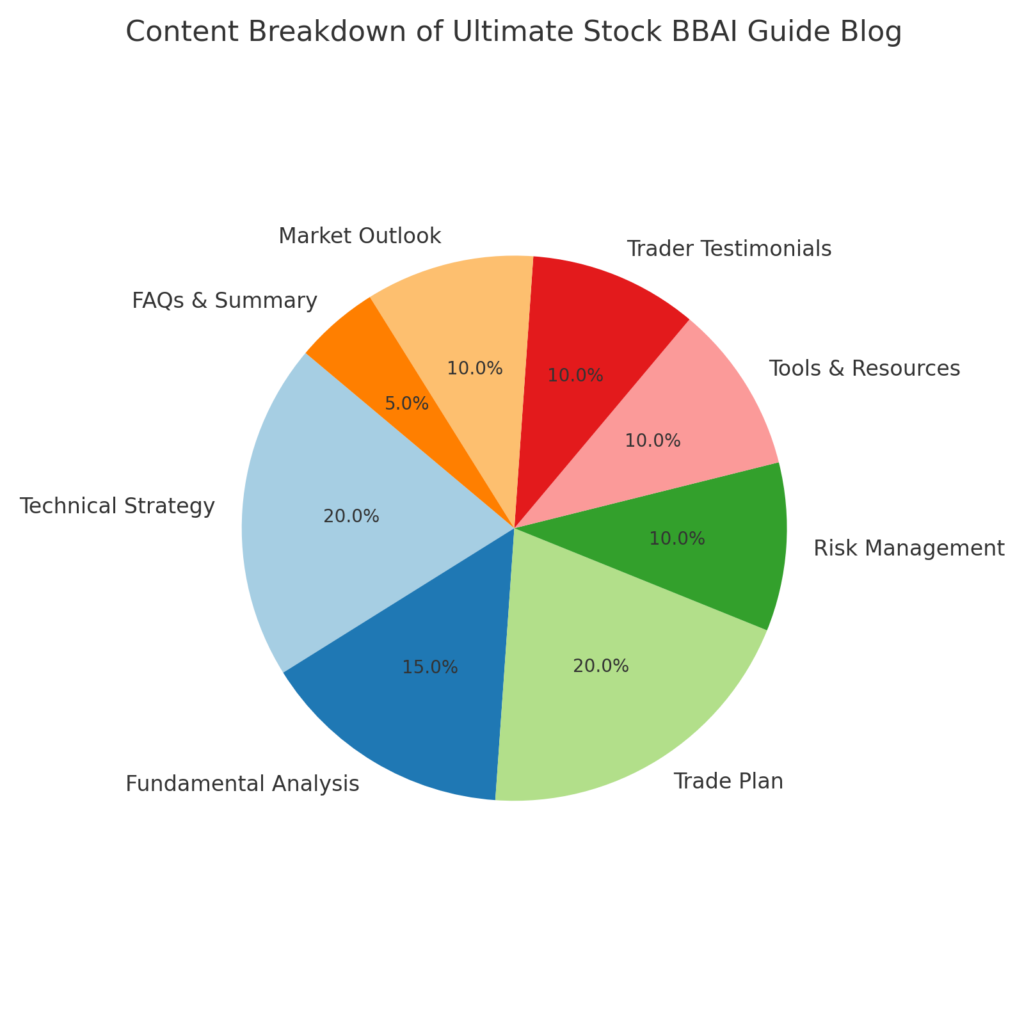

Here’s the pie chart showing the content breakdown of your “Ultimate Stock BBAI Guide”

Must-Have Tools for Stock BBAI Traders

To master this, traders use the following tools daily:

| Tool | Purpose |

|---|---|

| TradingView | Advanced charts + alerts |

| Finviz | Volume and insider activity scans |

| Webull | Fast executions + premarket access |

| Benzinga Pro | Real-time news + sentiment scanner |

These tools help identify moves early and execute with precision.

🗣️ Real Traders Share Their Stock BBAI Success Stories

“Caught a 42% move on stock bbai last Tuesday. It’s one of the few stocks I can count on for clean chart setups.” – Arjun, India

“I’ve traded over 100 stocks in the last 6 months. Only bbai has given me consistent 2-3 day swings.” – Michelle T., Canada

“The volume on stock is insane. If you know what you’re doing, you can print money with it.” – Jerome K., USA

Indicators to Watch in Stock BBAI This Week

Here’s a list of key indicators that often signal moves in stock:

- MACD Crossover on 4H Chart

- Daily RSI between 55-65

- 20%+ Relative Volume Spikes

- Bullish Engulfing Candlestick

- Positive Earnings or PR in Pre-market

These triggers, paired with tight entries, give you a tactical edge.

What’s Next for Stock BBAI in 2025?

Analysts and insiders believe stock bbai could move toward $4.00–$5.00 within this year due to:

- Expansion into commercial AI contracts

- Possible government renewals or AI budget surges

- Public enthusiasm around AI-driven infrastructure

For swing traders, that’s a goldmine waiting to be tapped.

Stock BBAI: Quick Dos & Don’ts for This Week

✅ DO:

- Follow news closely

- Trade with alerts on

- Keep watch on volume

❌ DON’T:

- Go all-in blindly

- Chase breakouts after big green candles

- Hold through earnings blindly

Final Thoughts

Stock bbai isn’t just another volatile ticker it’s a calculated trade waiting to reward the disciplined. With smart setups, proper tools, and risk-managed entries, you can realistically triple your gains within a week.

Whether you’re scalping on Monday or holding until Friday’s breakout, stock bbai is one of the few plays where skill meets opportunity in 2025.

FAQs

1. Is stock bbai a penny stock?

Yes, currently trading under $5, but with high liquidity and major upside.

2. How often should I trade with this stock?

Only when your chart setup confirms don’t force trades.

3. Is it good for day trading or swing trading?

Both! It offers strong intraday action and 2–4 day swing setups.

5. What’s the biggest risk with bbai?

Sudden sell-offs or dilution. Always use stops and size carefully.